Brooklyn has approximately 39,000 parcels within the qualified Opportunity Zones. Using the data provided by the Deepblocks data team, we know the zoned property use of every parcel, the potential total gross buildable [1] of each and it's lot size. If there is an existing building on it, we know the year it was built and an estimate of the building’s square footage.

Deepblocks BETA and Development Analysis

Deepblocks BETA provides over 36 initial market, building and financial assumptions when we model a development. These initial assumptions are auto-populated by Deepblocks and used to generate a 3D model (also called a ‘stacking plan’) when a project is created. This provides us with a starting point to begin to analyze a property and its potential. All project assumptions, such as total cost, return percentages, and the stacking plan itself update on the fly as adjustments are made. Making adjustments is simple and intuitive: we can use slider bars or input the data manually to customize our model.

This allows us to run different cost and return scenarios, based on current or future market conditions simply and efficiently. Cost assumptions, such as Land Cost or Hard Cost Per Square Foot can be easily adjustable to reflect the market we are analyzing. For instance, we can change the Land Cost, then adjust the Hard Cost per Property Use Type to reflect a Market Rate or Luxury Market development scenario - while getting automatically updated Return on Cost percentages.

Preliminary Development Study

Below are three different massing studies of a single lot I’ve selected from our Brooklyn data set. For each study, we'll differentiate between use type while maximizing our total potential gross buildable to realize which use would yield the greatest return.

Brooklyn Case Study: Option 1 - Multifamily

Analyzed using Deepblocks Beta

Use Type: Multifamily & Retail

Total Gross Buildable: 424,080 SF

Zoning Type: C6-4

ROC: 9.51%

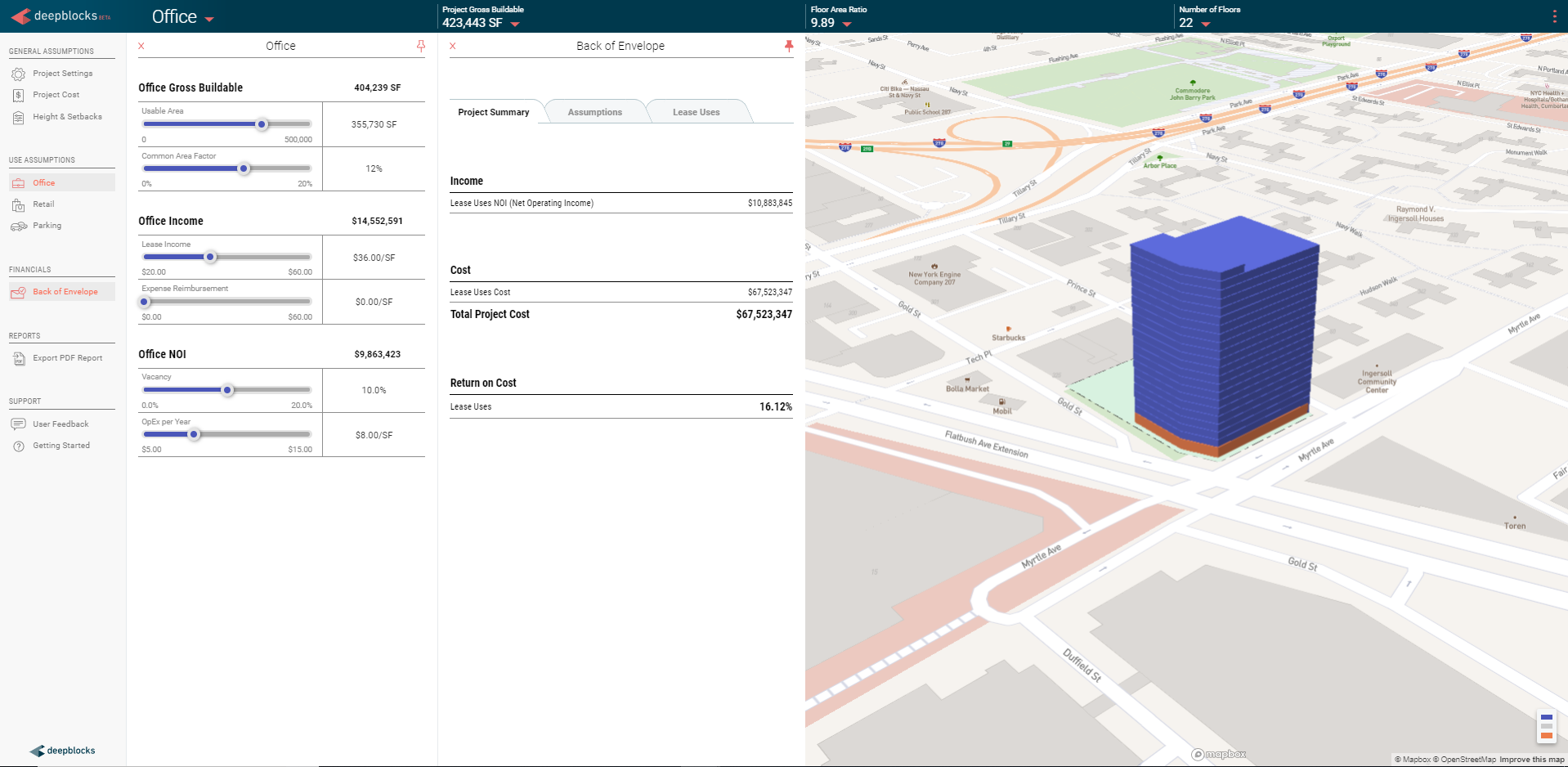

Brooklyn Case Study: Option 2 - Office

Analyzed using Deepblocks Beta

Use Type: Office & Retail

Total Gross Buildable: 423,466 SF

Zoning Type: C6-4

ROC: 16.12%

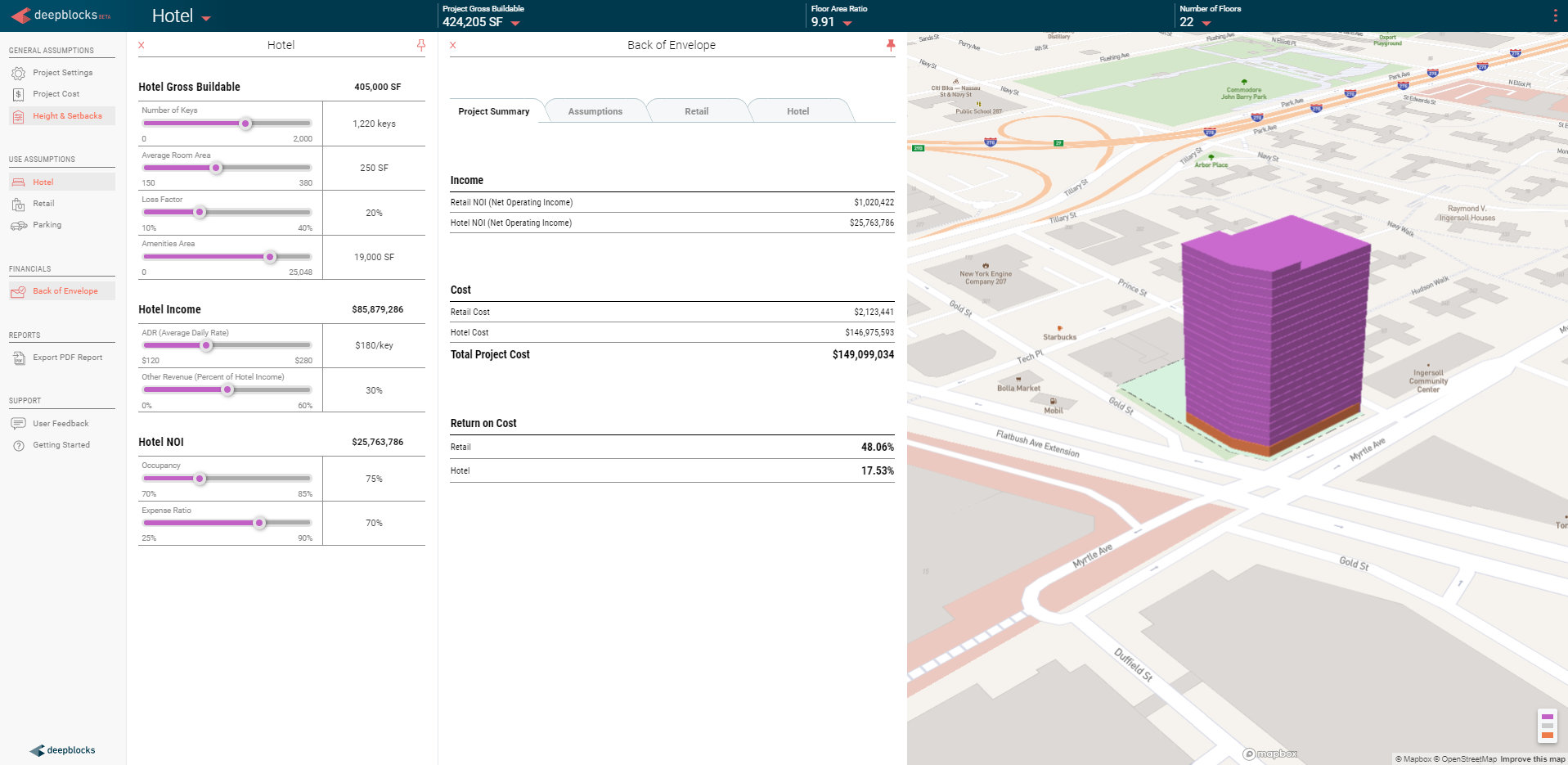

Brooklyn Case Study: Option 3 - Hotel

Analyzed using Deepblocks Beta

Use Type: Hotel & Retail

Total Gross Buildable: 424,205 SF

Zoning Type: C6-4

ROC: 17.53%

Case Study: Observations & Insights

The parcel has a potential total gross buildable of 427,184 SF. Being zoned C6-4 allows for Multifamily, Office, Retail and Hotel uses. These are our given development variables to run our preliminary analysis.

All the studies are similar in total gross buildable areas. The return on cost, on the other hand, vary to a much larger extent. A mixed-use of Hotel with Retail on the ground floor shows a potential Return on Cost of 17.53%, almost double the Multifamily option.

The cool thing is that our software allows us to continually adjust our hard cost and potential incomes (and all the 36 assumptions from the software), allowing us to keep refining until we find a scenario that fits our development profile for this parcel.

Conclusions

The power of the Deepblocks data set combined with our Deepblocks Beta software equals fast preliminary analysis:

The data provides a birds-eye view of every parcel in the city. The volume alone of parcels with this type of information is a huge value-add for national and local Opportunity Zone funds and developers.

The data provides unprecedented insight of what can be built, at a local level. To find out how to obtain these data sets [2], get in touch with us here.

Deepblocks Beta is a software tool to immediately visualize, adjust and analyze the potential of any parcel found via the data set. Combining both the data set (research) and the software (analysis) into a single workflow is an efficient, streamlined way to evaluate parcels and conduct feasibility studies.

Notes

Deepblocks provides an approximate potential total gross buildable using the zoned FAR value.

Data sets available: Miami, Miami-Dade Unincorporated, Tampa, Orlando, NYC, Chicago, Atlanta, Dallas, Austin and San Diego.